We have lived through a remarkable bull market in 2025. However, long-standing investor wisdom has proven repeatedly that “what goes down must come back up.”

Our goal is to manage your money through all market contingencies. That means both 1) the market’s growth periods and 2) potential downswings due to global scares, such as the Russian/Ukraine war, Trump Tariffs, inflation, and increasing interest rates. In every period, we must apply long-standing experience across all market contingencies, drawing on lessons learned from the past. Generally, this is why we need a professional advisor who relies on a team of analysts.

Market psychology has studied fear-based overreaction. Stock markets move, in reality, according to the mass psychology of the people. When most people optimistically believe the economy is healthy, they invest and stay invested. This belief has fueled the tremendous growth of our current economy as people continue to invest more of their savings in business ventures through equity investments.

Avoid the dangers of Market Presentism. Presentism is among the most pernicious tendencies of our age. The urge to view current markets only through the present markets’ sentiments and values – for example, Artificial Intelligence (AI) overexcitement about faster information processing – can reflect a lack of perspective. Just as always, seeing market history from the standpoint of the now corrupts our understanding of the past; peering ahead can distort our ability to make sound judgments about the future based on historical markets.

Danger can ensue by following the crowd. When many are fearful, the risk of following the crowd is that they can run out of the market in fear precisely at the wrong moment, increasing their extreme risk of loss. The collective feelings of the masses move market trends up or down.

History has shown that many have lost much of their savings not by staying in the market but by exiting their investment holdings in response to fear-based news. And many wise investors eventually see their investments return to normal, with often better gains in the future.

Your plan was carefully constructed to reflect your objectives and investment time horizon. Market declines may also represent an opportunity to buy quality companies at attractive prices. Warren Buffett, the famous billionaire investor, said:

“It is unwise to be fearful when…others are fearful.”

Avoid greed. When greed sets in during a bull market, investors without the guidance of an advisor can invest based on group gossip or speculation, or on social media influences. Assess the market with your advisor.

Emboldened by significant returns, retail investors have turned to riskier tools that use leverage to try to magnify their gains and, in the process, their influence over stock markets. Call options, for example, involve placing a bet that a stock will rise above a specific price within a particular period. If that bet pays off, the gain can be up to 10 times greater than simply investing in the underlying stock, depending on the option contract’s terms. If the stock stays below that price, the investor loses the entire amount. 1

The markets witnessed a fantastic recovery since the pandemic fears affected the market in March 2020, rising significantly into 2022.

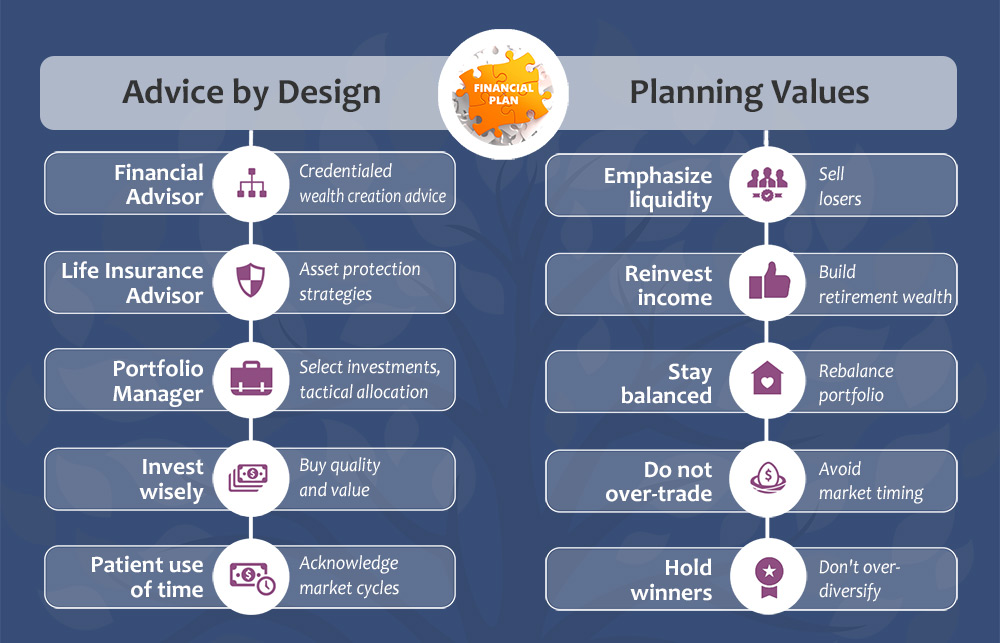

Stay the course. Over the long term, corrections are expected in the investment cycle. Investors who stay invested, rather than letting fear prompt them to try to time the markets, generally see future increases. The following graph shows the financial planning design and values for investing toward future financial security.

1, Globe and Mail